Fractional property investment in the UK is transforming real estate by allowing people to buy small shares in high-value properties. With rising housing costs, it offers an affordable, hassle-free way to earn rental income and capital growth. Managed platforms handle everything, making it a smart entry into property wealth in 2025.

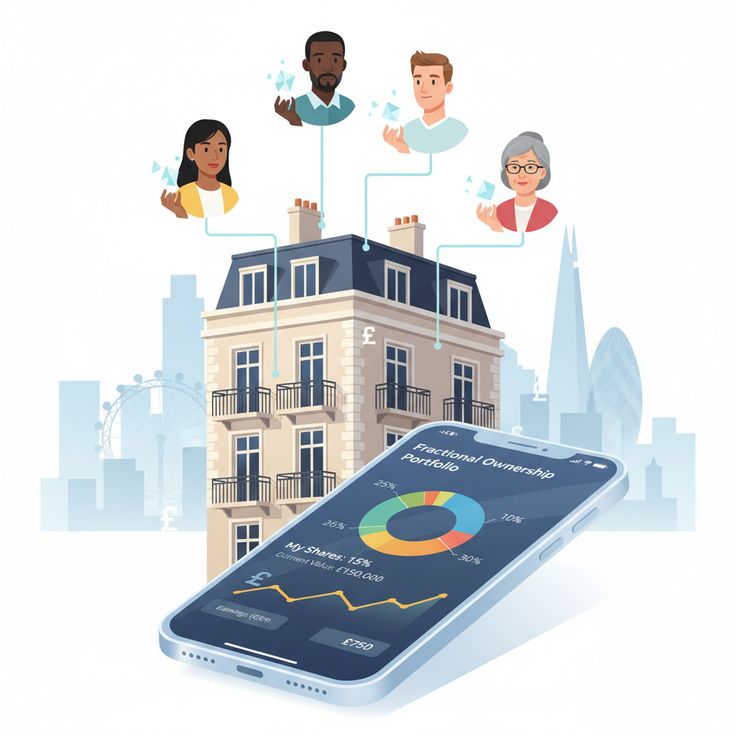

Fractional property investment UK is giving ordinary people a new way to own part of the property market without spending a fortune. Instead of buying an entire home, investors can purchase small shares in properties and earn from rent and rising values. It’s a simple, low-cost method that helps people grow wealth through real estate while avoiding mortgages or landlord work. With UK property prices staying high in 2025, this shared model is gaining huge interest. In this article, we are going to explain how fractional property investment in the UK works and why it’s becoming so popular.

What Is Fractional Property Investment and How Does It Work?

Fractional property investment means you buy a part of a property instead of owning the entire building. The total cost of the property is divided into smaller parts, called shares, which several investors can buy. Each investor owns a portion of the property, receives income from rent, and benefits from any rise in the property’s value.

For example, imagine a flat worth £400,000. A platform may divide it into 400 shares of £1,000 each. If you buy 10 shares, you own 2.5% of that property. The rent and profits are then divided according to each person’s share.

In the UK, fractional ownership is often handled through a Special Purpose Vehicle (SPV) — a company created just to own and manage that property. You become a shareholder in that company, not a direct landlord. The platform manages everything, from tenant searches to maintenance, while you enjoy passive income.

This model has made investing in property simpler and safer for those who cannot afford full ownership or do not want to handle property management responsibilities.

Why Fractional Property Investment Is Growing in the UK (2025)

Property prices in the UK have increased steadily, with the average home costing around £377,000 in 2025. Rising mortgage rates and the cost of living crisis have made traditional property investment much harder. These challenges have created space for more affordable options, such as fractional ownership.

People in the UK are now choosing fractional property investment because:

- It requires less money to start — many platforms allow investments from as little as £100.

- It is fully managed, so investors don’t have to worry about tenants or repairs.

- It allows diversification, helping investors spread risk across several properties.

- It gives access to prime locations like London, Manchester, and Birmingham.

- It can provide steady passive income in a market with strong rental demand.

Tech platforms have also made investing easier. Most now offer dashboards that show your property’s performance in real time, giving full transparency. The mix of technology, affordability, and convenience is why fractional property investment is becoming so popular in the UK.

Benefits of Fractional Property Investment UK

Fractional property investment offers a range of benefits that suit both beginners and experienced investors. The biggest advantage is accessibility. Unlike traditional property investing, which can cost hundreds of thousands of pounds, you can start with a small amount. This means that people who once found real estate out of reach can now take part in it.

Another clear benefit is convenience. Investors do not have to manage tenants, deal with maintenance, or chase rent payments. The platform takes care of all these tasks. It’s a completely passive form of investment.

It also provides a simple way to diversify your portfolio. You can invest in several properties in different cities rather than putting all your money into one. This lowers risk and increases the chance of steady income.

Transparency is another strength. Most platforms share regular reports, performance updates, and property valuations, so you can easily follow how your investment is performing.

Finally, it offers access to properties that individuals might never afford on their own — such as commercial buildings or premium apartments in central London — giving ordinary investors exposure to high-quality assets.

Risks and Considerations

No investment is risk-free, and fractional property ownership is no exception. Understanding the risks helps investors make better decisions.

The most common risk is market fluctuation. Property prices can fall as well as rise, and rental demand can shift. Even though the UK housing market has been stable, economic factors can still affect performance.

Liquidity is another concern. Selling your shares in a fractional property can take time. Some platforms have resale markets, but they may not always have enough buyers, so you might need to wait before cashing out.

Platform reliability also matters. Since these companies handle everything — from buying the property to managing it — you need to choose platforms that are FCA-regulated and have a proven track record.

There are also fees to consider, such as management charges or exit fees, which can lower your total returns.

Lastly, while fractional property investing reduces responsibility, it also means less control. You can’t make individual decisions about the property, like changing tenants or selling early, because these choices are made collectively or by the management company.

Despite these points, fractional property investment remains one of the safest entry routes into real estate when handled with care and research.

Costs and Return Potential in the UK Market

The amount you invest and the return you earn can vary depending on the platform, property type, and region. Minimum investments in the UK typically start from £100 to £5,000, making it affordable for small investors.

Average returns combine rental yield (income from tenants) and capital appreciation (growth in property value). In 2025, rental yields in the UK range between 4% and 8%, depending on the city. Northern regions such as Liverpool and Manchester offer the highest yields, while London properties deliver slower but steadier growth.

For instance, an investor putting £2,000 into a property that returns 6% annually would earn about £120 a year in rent, not including potential appreciation.

Fees charged by platforms, such as management or legal costs, usually range between 1% and 2% annually. While these fees slightly reduce profits, they also remove the need for personal involvement, saving investors time and effort.

In short, fractional property investment UK offers lower returns than risky ventures but far higher reliability and stability, especially compared with traditional savings.

Also read: How to Start an E-Commerce Business in 2025 (Step-by-Step Guide for Beginners)

Choosing a Reliable Platform for Fractional Property Investment UK

Selecting a trustworthy platform is essential because it directly affects the security of your investment. In the UK, many platforms are regulated by the Financial Conduct Authority (FCA), ensuring they follow strict investor protection rules.

When choosing a platform, investors should look for transparent communication, clear fee structures, and detailed project information. Reading user reviews and checking how long the platform has been operating can help determine reliability.

Some of the most trusted UK platforms in 2025 include Shojin, Bricksave, and Property Partner. Shojin focuses on institutional-grade UK developments, Bricksave provides access to global properties, and Property Partner allows small investors to buy shares in buy-to-let homes.

Before investing, make sure you understand how ownership is legally structured. The safest options are those that use SPVs, as they separate your investment from the platform’s operations. Also, review the platform’s exit options, as some allow you to resell your shares while others require waiting until the property is sold.

Choosing the right platform means balancing security, transparency, and accessibility — the three key elements of a reliable investment experience.

Legal and Tax Implications in the UK

When you invest in fractional property shares, you’re buying part of a company that owns the property, not the property itself. This is perfectly legal and is how most platforms structure ownership. Each investor is a shareholder in an SPV or trust that holds the property’s title.

From a tax point of view, any income you earn from rent is taxable as property income. You may also have to pay capital gains tax when the property is sold and you make a profit. However, depending on the platform, some investments can be made through Innovative Finance ISAs, which can offer tax advantages.

Unlike traditional property ownership, fractional shares typically don’t require you to pay stamp duty individually, though this can vary by platform.

It’s always recommended to seek advice from a tax professional to understand your obligations. Still, the UK system is generally investor-friendly, and fractional property investment has been fully integrated into the country’s regulated investment structure.

Exit Strategies and What to Expect

Before investing, you should always know how and when you can withdraw your money. Fractional property investments are not designed for short-term profits; most are intended to be held for three to five years.

There are usually two ways to exit: either by selling your shares through a resale marketplace offered by the platform or waiting until the property itself is sold. When the property is sold, the platform distributes the profits to all investors according to their ownership percentage.

It’s important to read each platform’s terms carefully, as some charge exit fees or have minimum holding periods. Because the property market moves slowly, investors should view fractional ownership as a medium to long-term investment. Those who are patient tend to see the best results, earning from both rent and value growth over time.

Read more: 7 Cheapest Card Payment Machines UK for 2025 Small Businesses

Regional Opportunities and Market Outlook in 2025

The UK property market continues to perform differently across regions, creating various opportunities for investors. London remains a strong and stable market, offering slow but consistent growth and high-value assets. However, yields are generally higher outside the capital.

Cities like Manchester, Birmingham, Leeds, and Liverpool are seeing strong demand for rental properties, driven by young professionals, students, and job growth. According to 2025 market reports, average rental yields in these regions are between 6% and 8%, making them excellent choices for investors seeking higher income.

Northern Ireland and Scotland are also becoming attractive due to lower entry costs and new infrastructure projects boosting demand. Fractional property platforms now list projects in these areas, allowing small investors to benefit from local growth without having to manage a full property.

Overall, the 2025 outlook for fractional property investment UK is positive, with steady rental demand and limited housing supply helping maintain good returns for long-term investors.

Conclusion

Fractional property investment UK is opening the door for more people to build wealth through real estate without owning a whole property. It offers simple entry, steady rental income, and long-term growth potential, all managed by trusted platforms. Though risks like market changes exist, careful planning and regulated providers make it a smart, modern choice. For anyone wanting property-backed income without the stress of being a landlord, fractional investment in the UK is a practical and rewarding way to start building financial freedom.

FAQs

1. Is fractional property investment legal in the UK?

Yes. Fractional property investment is legal in the UK when it’s properly structured, usually through a company called a Special Purpose Vehicle (SPV) that owns the property. Most reputable platforms operate under Financial Conduct Authority (FCA) rules, giving investors added protection.

2. What minimum amount do I need to invest?

The minimum investment depends on the platform and property type. Some UK platforms allow investments starting from a few hundred pounds, while others may require several thousand. In most cases, you can start with as little as £100 to £5,000.

3. Can I sell my share whenever I want?

Not always. Liquidity can be limited in fractional property investment. Some platforms offer resale marketplaces where you can sell your shares to other investors, while others require you to wait until the property is sold or the investment term ends.

4. What kind of returns can I expect?

Returns vary depending on location, property type, and market conditions. Many investors see combined annual returns between 4% and 8%, including both rental income and capital appreciation. Northern cities often provide higher rental yields than London.

5. What taxes apply to fractional property investment UK?

Income from your shares is subject to UK income tax, and profits made when selling your shares may be liable for capital gains tax. Some platforms offer tax-efficient options such as Innovative Finance ISAs (IFISAs) that can help reduce tax on your returns.

6. What happens if the investment platform fails?

Most fractional property investments are held through separate legal entities (SPVs), meaning your ownership is independent of the platform itself. If the platform closes, your investment remains tied to the property, though management of the asset might transfer to another provider.

7. Can overseas investors participate in UK fractional property investment?

Yes. Many UK platforms welcome investors from outside the UK. However, overseas investors should consider local tax laws, exchange rate fluctuations, and any additional verification requirements before investing.

8. Is fractional property investment the same as timeshare or shared ownership?

No. Timeshares offer usage rights to a property for specific periods, while fractional property investment gives you actual ownership shares and a portion of the income. Shared ownership is a government housing scheme and operates very differently from fractional investing.