Starting a business is exciting, but success depends on more than a great idea—it hinges on smart financial planning. In today’s fast-moving economy, where inflation, technology, and competition shape every decision, having a clear financial roadmap is what separates thriving ventures from struggling ones. Financial planning isn’t just about managing money; it’s about turning vision into strategy, risk into opportunity, and goals into measurable results. This guide empowers entrepreneurs to master every stage—from budgeting and forecasting to funding and growth—so you can build a business that’s not only profitable but built to last.

What Is Financial Planning

Financial planning is the process of evaluating a business’s current financial position, setting long-term and short-term goals, and developing strategies to achieve them. It involves forecasting revenue, estimating expenses, analyzing risks, and managing cash flow efficiently. Essentially, it’s the blueprint that guides every financial decision—from launching a new product to expanding into new markets. A sound financial plan gives clarity on how much capital is needed, where it will come from, and how it will be used to achieve business objectives. It also ensures that financial resources are allocated wisely, minimizing waste and maximizing growth potential. Without a structured plan, even the most promising business ideas can fail due to poor money management or lack of foresight.

Why Financial Planning Matters

Behind every successful company lies a carefully designed financial plan. It gives your business direction, helps you avoid costly mistakes, and prepares you for challenges before they arise. Financial planning transforms your vision into measurable, actionable steps. It answers essential questions like: How much do you need to start? When will your business break even? What expenses are unavoidable, and where can you save? A strong financial plan does more than just track money—it builds confidence, supports better decisions, and attracts investors. Businesses with solid financial planning aren’t just stable; they’re adaptable and resilient, capable of thriving even in uncertain times.

Step 1: Strengthen Your Personal Finances

Before creating a financial plan for your business, secure your personal finances. Your personal stability becomes your startup’s foundation. Start by evaluating your current expenses—rent, utilities, subscriptions, and other monthly costs. Identify where you can reduce spending if income drops once you begin your business. Next, review your personal debts and create a repayment strategy. Clear high-interest loans or credit card balances before quitting your job. Finally, build an emergency fund that covers six to twelve months of living expenses. This financial cushion allows you to focus on your startup full-time without worrying about daily bills. When your personal finances are steady, you gain the freedom to take entrepreneurial risks confidently.

Step 2: Define Clear Business Goals

Every successful plan begins with purpose. Define what you want your business to achieve—both financially and operationally. Your goals should be realistic, specific, and measurable. For example, you might set a target to reach $100,000 in revenue in your first year or achieve a 20% profit margin by the end of your second year. Financial goals guide your actions, help you measure progress, and make it easier to attract funding. Align them with your broader vision so that every financial decision contributes directly to long-term success.

Step 3: Estimate Startup Costs

Before launching your business, determine exactly how much it will cost to get started. Create a list of all expenses: registration fees, product development, technology, marketing, equipment, and labor. Classify them into fixed costs (like rent, insurance, and salaries) and variable costs (like materials, utilities, or commissions). Once you calculate the total, add an extra 10–15% as a contingency for unexpected expenses. Many startups fail because they underestimate costs in the early stages. Planning for the unexpected ensures you’re financially prepared for surprises.

Example: Startup Financial Allocation

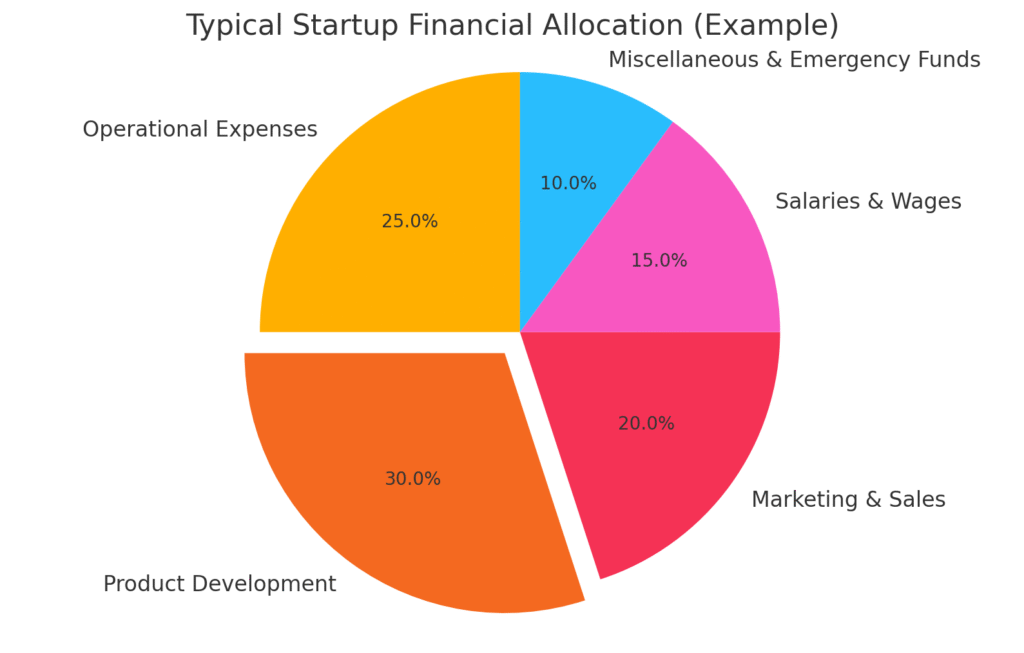

To visualize how most startups distribute their initial funds, here’s a sample financial allocation pie chart that shows how expenses might typically be divided in the first year of operations.

Typical Startup Financial Allocation:

- Operational Expenses: 25%

- Product Development: 30%

- Marketing & Sales: 20%

- Salaries & Wages: 15%

- Miscellaneous & Emergency Funds: 10%

This chart represents a sample financial breakdown for a startup’s first year. Most funds go to product development (30%) and operations (25%), followed by marketing (20%), salaries (15%), and emergency reserves (10%). Percentages may vary by industry and business model but offer a clear snapshot of balanced startup spending.

Read more: 20 Successful Small Business Ideas in the UK for 2025

Step 4: Forecast Revenue and Cash Flow

A revenue forecast translates your vision into numbers. Estimate how much you’ll earn monthly based on market research, pricing strategy, and target audience size. Be realistic and conservative—overestimating sales can lead to unnecessary debt. Pair your revenue forecast with a cash flow plan that shows when money will actually come in and go out. A business can be profitable on paper but still fail if cash isn’t managed properly. Monitoring cash flow ensures you can pay bills, handle emergencies, and maintain operations without disruption.

Step 5: Create and Maintain a Budget

Your budget is the backbone of your financial plan. It helps you control expenses, allocate resources, and stay accountable. Begin by separating your expenses into fixed, variable, and discretionary categories. Fixed costs include rent, salaries, and utilities. Variable costs fluctuate with production or sales. Discretionary spending includes non-essential expenses like events or bonuses. Compare projected income against total expenses to ensure profitability. Review your budget monthly to spot deviations early. A disciplined budget keeps your finances organized and prevents overspending.

Step 6: Select the Right Funding Source

At some stage, your business may need external funding. The right financing option depends on your business model, goals, and appetite for risk. Personal savings are the most common starting point, but don’t overextend yourself. Friends and family funding can help in early stages but should come with clear agreements. Angel investors and venture capitalists can provide significant funds and mentorship but often require equity. Grants and accelerator programs offer smaller sums but valuable exposure. Crowdfunding platforms are another option for product-based startups. Choose funding methods strategically—always know how much you need, what you’ll give up, and how you’ll use the money efficiently.

Step 7: Prepare Key Financial Documents

Strong documentation builds trust with investors and helps you make smarter decisions. The three essential financial statements are the income statement, balance sheet, and cash flow statement. The income statement (profit and loss) shows your revenue, expenses, and overall profitability. The balance sheet presents your assets, liabilities, and equity—essentially what you own and owe. The cash flow statement records how money moves in and out of your business, highlighting liquidity. Keeping these statements updated regularly allows you to assess performance and plan improvements quickly.

Step 8: Plan for Risks and Contingencies

Every business faces challenges—economic shifts, delayed payments, or sudden cost increases. A contingency plan ensures you can handle them without panic. Keep an emergency fund covering three to six months of operating expenses. Diversify income streams to reduce dependency on one customer or product. Secure business insurance to protect assets and manage liabilities. Create alternative supplier and funding options to minimize disruption. A business that anticipates risks stays stable even in uncertain times.

Step 9: Track, Measure, and Adjust

Financial planning is not a one-time task—it’s an ongoing process. Review your plan monthly to compare projected results with actual outcomes. Analyze whether revenue goals are being met and whether expenses align with your budget. Use key performance indicators such as gross margin, net profit, cash flow ratio, and customer acquisition cost. When you identify gaps, adjust your strategy quickly. Regular monitoring helps you stay proactive rather than reactive, ensuring your business remains financially healthy.

Step 10: Focus on Long-Term Growth

Once your business stabilizes, look beyond short-term profits. Strategic financial planning focuses on growth, expansion, and innovation. Reinvest profits into improving technology, hiring skilled employees, or entering new markets. Develop systems that automate processes and reduce manual errors. Explore tax-efficient investment and savings options to maximize returns. The goal is not only to sustain but to scale your business responsibly. Long-term planning transforms your startup from a temporary venture into a lasting brand.

Common Mistakes to Avoid

Many entrepreneurs fail not because of bad ideas but because of poor financial management. Avoid common errors such as overestimating sales, underestimating expenses, neglecting cash flow, and mixing personal with business finances. Don’t ignore financial reviews—update your plan frequently. Always have a contingency budget and keep detailed records of every transaction. Smart entrepreneurs know that consistent planning prevents future crises.

Read also: How Do I Start a Taxi Business? A Step-by-Step Guide for Beginners

Real-Life Example

Riya, a young entrepreneur, wanted to start a handmade skincare line. She didn’t rush in blindly. First, she saved eight months of personal expenses, paid off her debts, and created a simple budget. She worked on her product while keeping her day job. Once she gained loyal customers, she launched full-time. She prepared detailed financial projections and approached an angel investor with a clear plan. Her preparation impressed the investor, who funded her business. Within a year, Riya’s brand broke even and became profitable. Her story shows that proper financial planning turns ideas into sustainable businesses.

Conclusion

Financial planning of a business is not just about managing money—it’s about shaping your future. When you plan your finances, you move from uncertainty to control, from hope to action. You understand where you stand, what you can achieve, and how to get there safely. Whether you’re launching your first startup or expanding an existing one, financial planning gives you the clarity and structure to make smart decisions. The businesses that plan don’t just survive—they thrive.

FAQs

Q1. How do I start financial planning for my business?

A: Start by setting financial goals, analyzing your current finances, estimating startup costs, forecasting income, and building a detailed budget.

Q2. How much money should I save before starting a business?

A: Aim to save six to twelve months of personal living expenses to reduce financial pressure during your startup phase.

Q3. What financial documents should every business have?

A: Maintain an income statement, balance sheet, and cash flow statement to track performance and financial health.

Q4. How often should I review my financial plan?

A: Review it monthly for progress, quarterly for strategy adjustments, and annually for long-term updates.

Q5. What’s the most common mistake new founders make?

A: Overestimating sales and ignoring cash flow issues. Always plan conservatively and maintain a backup fund.

Q6. Can financial planning help attract investors?

A: Yes, investors prefer businesses with strong financial clarity. A detailed, realistic plan builds trust and increases funding opportunities.